When Paul tweeted Sallie

Wow, it looks like I just picked my first Twitter fight.

In the little world of personal finance, Sallie Krawcheck is famous for being, well, famous. She received a lot of prominence over a decade ago for trying to give thoughtful investment analysis of companies, while others in her field were perfectly willing to say whatever had to be said (I am looking at you Henry Blodget) in order to raise investment banking business (read: $$$) for their firms.

Sallie parlayed that into some very prominent positions at some very prominent firms. At a very young age, she reached positions of senior management at some of the biggest names on Wall Street: Sanford Bernstein, Smith Barney, Citigroup, and Bank of America/US Trust/Merrill Lynch (after their financial-meltdown inspired shotgun marriage). She also didn’t last very long at any of them.

But Krawcheck is now between gigs, and has some time on her hands to contribute blog pieces to places like LinkedIn, one of which passed my desktop last week. Here is that piece. Reasonable, if vague advice. The problem I had was that she made millions of dollars leading organizations that were devoted to doing anything but these five things. And not just one organization, all of them.

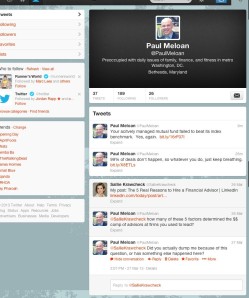

Since I follow her Twitter feed, I posted a query, admittedly with a gentle sprinkling of snark attached: (CLICK IMAGE TO ENLARGE)

Now I am blocked. Cold shoulder.

Sadly, I bet we would get along nicely if we ever met. Her profile highlights her background as a runner (which I dig) and she currently boasts of an unhealthy following of her beloved UNC Tar Heels, which I can understand and forgive. I think we were both quite happy when Duke lost yesterday. (Go Blue!)

View Comments

meet your takers?

Wow, it looks like I just picked my first Twitter fight. In the little world of...